Find consumer tips on everything from credit to home safety to travelling on a budget and so much more!

Life Insurance Planning Calculator

Use this Life Insurance Calculator to help estimate your current expenses and debt and how they could impact end-of-life expenses.

Ready to Get Started?

Using the Life Insurance Planning Calculator is quick and easy. Simply click the yellow button below. The calculator will have places for you to include your current mortgage, education and other expenses and will project your life insurance needs.

Union Plus Life Insurance is underwritten by Hartford Life and Accident Insurance Company, Hartford, CT 06155. All benefits are subject to the terms and conditions of the policy. Policies underwritten by Hartford Life and Accident Insurance Company detail exclusions, limitations, reduction of benefits and terms under which the policies may be continued in force or discontinued. Life Form Series includes GBD-1000, GDB-1100 or state equivalent.

Do you have enough life insurance? Explore whether your life insurance coverage is sufficient to cover your dependents’ expenses in the future.

Insurance 101

Insurance is not a "set it and forget it" decision — you’ll want to re-evaluate your needs on a regular basis or at major life events such as a new job, moving to a new area, or birth of a child. This module will explore different types of policies, how insurance works, and how it affects your money to help make sure you have the plan that works best for you.

Ready to Learn More?

Watch our Insurance module. It's quick and easy. Simply click the yellow button at the bottom of this page. The module will start playing as soon as you arrive on the site. Once you've listened to the introduction, click the arrow to the right of the screen to move through the three different topics:

- Types of policies

- Common costs

- Processing claims

Tips

Once you've started the module, you can see captions, adjust volume and pause the module by using the controls at the top right of the screen. You can also select the transcript button to see all of the content from the module.

Union Plus Life Insurance is underwritten by Hartford Life and Accident Insurance Company, Hartford, CT 06155. All benefits are subject to the terms and conditions of the policy. Policies underwritten by Hartford Life and Accident Insurance Company detail exclusions, limitations, reduction of benefits and terms under which the policies may be continued in force or discontinued. Life Form Series includes GBD-1000, GDB-1100 or state equivalent.

Insurance can help protect you, your loved ones, and your property from unexpected financial risk or loss, and is a key part of any financial plan.

Understanding Auto Loans

When purchasing your next car, it's important to understand the entire cost and duration of your loan and to get all the facts, upfront, so you can make the decision that best fits your life.

Ready to Learn More?

Watch our Understanding Auto Loans module. It's quick and easy. Simply click the yellow button at the bottom of this page. You'll then see the "Understanding Auto Loans" page. To start watching, simply click the orange "play" button. This video will include helpful information about auto loans, such as:

- How are auto loans financed?

- How long are the terms of the loans?

- What's the difference between a fixed rate loan and a variable interest rate?

Tips

Once you've started the module, you can see captions, adjust volume and pause the module by using the controls at the top right of the screen. You can also select the transcript button to see all of the content from the module.

So, you’re ready to buy a new car. But, you have to figure out the best loan for your needs. Don't worry, we've partnered with Everfi, Inc. to help you understand the process!

Don’t Let Vet Bills Haunt Your Halloween

Including pets in holiday festivities is becoming the norm as pet ownership rises, and Halloween is no exception. But beware of potential hazards this time of year may bring such as Halloween candy and costumes as they present opportunities for pets to enjoy non-traditional “treats” that could lead to unexpected vet bills.

Over the last three years, claims for pets ingesting toxic foods or foreign objects consistently ranked among the top 10 accident claims during the month of October. Accident claims due to toxic foods or foreign object ingestion increased 5% in October 2017 compared to the prior year, representing 19% of all accident claims during the month*.

Help reduce your pet’s risk by taking proper precautions this Halloween season:

- Keep Halloween treats away from pets. While chocolate is one of the most toxic to dogs and cats, candy containing xylitol, grapes, and raisins should also be kept out of reach. Make sure wrappers find their way into the trash, as these also present a risk to pets if ingested.

- If dressing your pet up in a Halloween costume this year, be sure to inspect the costume for any small or loose pieces that might be easily chewed off and swallowed. Beware of these hazards on human costumes as well.

- Keep seasonal Halloween décor, like lights and candles, in out of reach areas for pets. Pets may want to play or chew on smaller objects or loose items, resulting in a potential choking hazard.

If you know or suspect your pet has ingested a toxic food or foreign object, it is important to seek veterinary care as soon as possible. Unexpected veterinary costs can be scary but having pet insurance can help take the fright out of those expensive veterinary bills.

Accident plans are only $6/month for cats and $9/month for dogs (pricing varies in Washington). If you’d like to include illness coverage, there are comprehensive BestBenefit Accident and Illness plans available.

Learn more about

Union Plus Pet Insurance

*Based on Pets Best claims data from 2015, 2016, and 2017

Pet insurance offered and administered by Pets Best Insurance Services, LLC is underwritten by American Pet Insurance Company (APIC) or Independence American Insurance Company (IAIC). Please visit www.americanpetinsurance.com to review all available pet health insurance products underwritten by APIC.”

Halloween is fun for pets too, take these precautions to keep your pet healthy and safe this year. Union Plus Pet Health Insurance reimburses cat and dog owners for veterinary expenses when their pets get injured.

Buyer Beware: How to Avoid Buying a Flood Damaged Vehicle

With around 5 million vehicles in the wake of Florence, flood damaged vehicles could run in the thousands. “While, hopefully, these vehicles will have their titles marked flood damaged and go to salvage yards, many will likely re-enter the market as used cars,” said Jack Gillis, the Consumer Federation of America’s Executive Director and author of The Car Book. “Because of the computerization, electronics and sophisticated safety technology in today’s vehicles, it’s critical that you avoid getting stuck with one of these lemons.”

“Looks can be deceiving—with a nice clean up, these water infested vehicles, may actually look pretty good—which means knowing how to identify a flooded vehicle is critical. When it comes to buying a car, three out of four of us buy used. So there’s a big incentive for disreputable sellers to move flood damaged vehicles north hoping to sell them to unsuspecting buyers,” said Gillis. “While luckily less cars have been flooded compared to Harvey and Irma, flooded cars remain a significant risk to unsuspecting consumers. By following these tips, consumers can protect themselves from purchasing a vehicle which can put themselves and their families at risk,” Gillis continued.

Ten Tips for Avoiding a Flood Damaged Vehicle

- Check the VIN (Vehicle Identification Number) which is located on the driver’s side dashboard, visible through the windshield, with the National Motor Vehicle Title Information System established by the U.S. Department of Justice. You’ll have to pay a small fee for the information, but it’s the most comprehensive data base. You can also check with the National Insurance Crime Bureau (NICB) or CarFax (both currently offering free flood history information). Even if the database has no flood information, beware, as fraudsters have ways of getting around VIN registration information or it simply wasn’t reported.

- Use your nose. Beware if the vehicle smells musty or damp or if you smell some kind of air freshener. Close up the windows and run the air conditioner and check for a moldy smell.

- Look for dirt, mud and water stains. Check the carpets, seat upholstery, cloth lining inside the roof, if you see any dirt or mud stains, beware. Feel under the dashboard for dirt or moisture and look in the glove boxes, ashtray, and various other compartments for moisture or stains. If you see straight stain line either on the inside of the door panel, engine compartment or trunk—watch out, that’s probably how high the water went in the vehicle. Tip: If the carpeting, seat coverings or headliner seem too new for the vehicle, that’s a sign that they may have been replaced due to flood damage.

- Listen for crunch. Pull the seats forward and back and try all of the safety belts. If you’re looking at an SUV with folding seats, try folding them all. Listen for the ‘crunchy’ sound of sand or dirt in the mechanisms or less than smooth operation.

- Check the spare tire (or inflator) area. Look for mud, sand or stains on the spare tire and jack equipment and the well under the spare tire. Check under the trunk carpet for a rigid board and look to see if it is stained or has water damage.

- Power up. Be sure to try all the power options including windows, locks, seats, moon roof, automatic doors, wipers, window washers, lights, AC system, etc. If any don’t work, sound funny, or operate erratically, beware. And don’t forget the sound system. Try out the radio, CD player and Bluetooth connectivity. Adjust the speakers front and back and side to side to listen for any crackling or speaker failure.

- Check for rust or corrosion. Look around the doors, in the wheel wells, under the seats, under the hood and trunk and inside the engine compartment.

- Look under the hood. Look at the air filter. It’s often easy to check and will show signs of water damage. Check the oil and transmission fluid. If it looks milky or has beads of water, watch out.

- Take a test drive and listen for unusual engine or transmission sounds or erratic shifting and acceleration. Set the cruise control to see if it is working properly.

- Check out the head and tail lights; look closely to see if there is any water or fogging inside. Same with the dashboard—are any of the gauges foggy or containing moisture droplets.

Contact: Jack Gillis, 202-939-1018

Union members buying a preowned vehicle are eligible for a free CarFax Reports on most vehicles.

With Florence flooding thousands of vehicles, there’s a good chance unscrupulous sellers will try and sell these potentially dangerous vehicles.

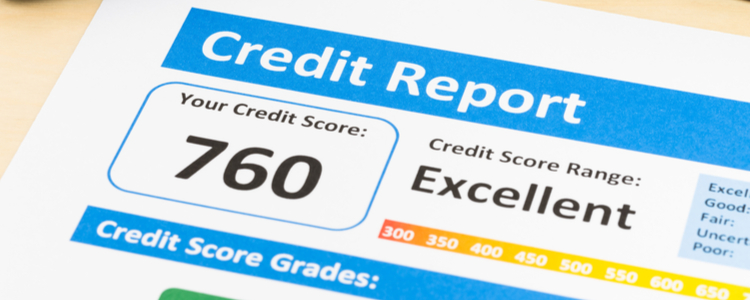

Debunking Common FICO Myths and Misconceptions

We’re here to turn that around.

The Most Common Myths About FICO Scores, Debunked:

- You Have Only One FICO Score

It turns out that you actually may have dozens of FICO Scores. The same goes for the VantageScore®, or any score for that matter, explains credit card expert John Ulzheimer, formerly of FICO and Equifax.

“The FICO is a brand, not a specific score,” says Ulzheimer. “And there are many different scores. Afterall, there are three credit bureaus and several generations of FICO's scoring software still in use today.”

These different scores may be used for different purposes. For instance, there are versions used for when you apply for an auto loan (i.e., FICO Auto Score 8), in credit card decisioning (i.e., FICO Bankcard Score 8), and for mortgage lending (i.e., FICO Score 2).

Ulzheimer further explains: “So when someone says, ‘My FICO Score is 700,’ that’s only as accurate as saying, ‘One of my FICO scores is 700 as of right now.’ “

- A Credit Score Is Part of Your Credit Report

When you order a credit report, your score isn’t actually an official part of the report. That’s why you’re not entitled to annual free credit scores like you are with credit reports, which you can get one for free from each of the three credit bureaus within a 12-month period, explains Ulzheimer.

“Credit scores, regardless whether it’s the FICO or VantageScore, are an add-on product sold along with a credit report,” says Ulzheimer. “Think about leather interior or heated seats as an upgrade to a car.” That’s why oftentimes there’s a fee you have to pay to get your credit score.

While there is typically a fee, these days many credit card companies and credit monitoring services offer a “free credit score.” Even though they are promoted as being free to you, the consumer, the company offering the free score is paying for them in some form, explains Ulzheimer.

- FICO Scores Are Used to Determine Premiums on Insurance

While credit scores can determine your terms and rates on car loans, mortgages, credit cards, and the so forth, they aren’t a factor in setting the premium on homeowners insurance and auto insurance. “Many insurance providers do leverage credit information in the decision process in granting insurance, but not FICO scores, which are designed to predict credit risk, not insurance risk,” says Tommy Lee, principal scientist at FICO.

Instead of using credit scores, lenders oftentimes look at credit-based insurance scores to assess how likely someone will have an insurance loss. That’s because research reveals a correlation between credit-based insurance scores and losses.

- FICO Scores Are Used During the Employment Screening Process

Here’s the difference: Credit reports can be used during the employment screening process when you apply for a job, but the credit scores themselves are not included on those types of reports, explains Ulzheimer.

“This is a hard one to kill,” says Ulzheimer. “So many people use the terms ‘credit score’ and ‘credit report’ interchangeably, which is why the myth persists.” Remember: a credit report is record of your credit history, whereas a credit score is an algorithm used to determine your credit risk and creditworthiness.

- Your FICO Score Factors in Your Income

Another common misconception is that the FICO® Score considers your income. The truth is that verified income is not found in the credit report, explains Lee. The same goes for the balances in your checking and savings accounts, and other assets, such as how much you have sitting in your retirement nest egg.

If you’re confused as on what the score is based on, look no further than your credit report. So think revolving loans, such as credit cards, and installment loans, such as car loans, mortgages, and personal loans.

- Married Couples Share a FICO Score

Married couples do not share credit scores or credit history. “Each partner has their own distinct credit report,” says Lee. “The only credit obligations that show on your report are those you signed up for, including those you had before you got married.”

However, if you add your spouse an as authorized user on your credit cards, while they aren’t responsible for making payments, the account will most likely will show up on their credit report. So if you’re making on-time payments, it could help build their credit score. Conversely, if you’re late, it could ding their credit.

- You Have to Carry a Balance on Your Credit Cards to Build a Credit History

Carrying a balance on your credit card — and not paying off your balances in full each month — to build your credit history is simply false, explains Lee.

“Carrying balances from month to month and incurring interest fees does not help your score,” says Lee. “ Instead, what matters is that you are keeping the balances reported in your credit file—typically your credit card statement balances—relatively low, especially in comparison to your credit limits.”

So how can you build your credit history and boost your score? As your payment history makes up 35 percent of your credit score, be careful not to make any late or missed payments. You’ll also want to keep your debt-to-limit, or credit utilization ratio, low. That’s because the second most important category in the FICO® Score calculation is your “amounts owed,” which makes up some 30 percent of the score calculation. You can use the FICO Score Planner to learn tips and tricks to reach your target score. You can also work with a nonprofit credit counseling agency to review your credit report and determine an action plan to improve your credit health over time.

No matter what the credit scoring model, it plays a huge role in determining your purchasing power as a consumer. If you have questions about the FICO Score and how it works, reach out to an expert at Money Management International today.

Jackie Lam is an L.A.-based personal finance writer who is passionate about helping creatives with their finances. Her work has appeared in Forbes, Mental Floss, Business Insider, and GOOD. She blogs at heyfreelancer.com.

The following is presented for informational purposes only and is not intended as credit repair.

While you probably know what a FICO® Score is, there may be a cloud of confusion over how it’s calculated, how to build good credit, and how it ultimately affects your life as a consumer. Don’t worry, you’re not alone. It turns out that there are pervading misconceptions about FICO Scores that just won’t die. Union families can turn to Union Plus Credit Counseling through the non-profit Money Management International (MMI).

Pet Insurance 101

What is Pet Insurance?

Pet insurance reimburses you on your veterinary bills when your dog or cat gets sick or injured. Pet insurance helps you afford the best course of treatment, protects against major financial setbacks, and can give you peace of mind as a pet parent. Having a pet insurance plan allows you to focus on getting the best care for your pet without worrying about the financial burden.

When Should I Get Pet Insurance?

It’s important to insure your pet when they’re still healthy, because no pet insurance plan covers pre-existing conditions. Pet insurance coverage does not start immediately, and while Pets Best offers some of the shortest waiting periods in the industry and we don't require an exam to enroll, the earlier you get pet insurance the more likely you'll receive the maximum benefit from it.

Why Do I Need Pet Insurance?

It's a sad fact: dogs and cats get sick and injured just like us humans. We've all heard the horror stories about dogs that had to have their own toys surgically removed after an accidental swallowing. Or the story about the cat that got diabetes or chronic renal failure. Or the pair of Golden Retrievers that developed cancer. The story always ends the same way: the veterinary bills were enormous, making matters worse.

Vet bills will continue to be a challenge for pet parents in the face of rising veterinary costs. The equipment at your vet's office is now human-grade. The same MRI machine used at your doctor's office could be the same one at your veterinarian's clinic. Medical advances and high-end equipment give your pets the best chance at a long, happy, and healthy life, but this advancement often comes with a high price tag.

How Pet Insurance Works

You shouldn't have to worry about getting your pets the best veterinary treatment they deserve. Once you have enrolled, using pet insurance is as easy as:

- Get Treatment

When your pet becomes ill or injured, get treatment from any veterinarian of your choice

- File a Claim

We make it easy with online claim filing, and there is no need to send medical records unless we request them

- Get Cash Back, Fast

We process most claims in five days or less and can deposit them directly in your bank account

Learn more about the Union Plus Pet Insurance program, powered by Pets Best, that offers savings of up to 10% off monthly premiums to union members.

Having pet insurance can help reduce the cost of veterinary bills, but how does it work? Union Plus Pet Health Insurance reimburses cat and dog owners for veterinary expenses when their pets get injured. There are different plans available to help you get the coverage that meets your pet's needs.

Save on Prescription Medications on a Limited Income or Without Insurance

There are several programs that are available to Medicare beneficiaries to help save money on your prescription drug costs. These include Extra Help and State Pharmaceutical Assistance Programs (SPAPs). There are also resources available for union members through Union Plus.

Extra Help

Extra Help is a federal program that helps pay for some to most of the out-of-pocket costs of Medicare prescription drug coverage. If your monthly income is up to $1,538 in 2018 ($2,078 for couples) and your assets are below specified limits, you may be eligible for Extra Help.

Even if your income or assets are above the eligibility limits, you could still qualify for Extra Help, because certain types of income assets may not be counted. If you are enrolled in Medicaid, Supplemental Security Income (SSI), or a Medicare Savings Program (MSP), you automatically qualify for Extra Help.

The Extra Help program pays for your Medicare Part D premium up to a state-specific benchmark amount. It also lowers the costs of your prescription drugs. People with Extra Help have a monthly Special Enrollment Period (SEP) to enroll in a Part D plan or switch between plans in 2018. In 2019, Extra Help gives you an SEP to enroll in or switch Part D plans once per quarter in the first three quarters of the year (January through March, April through June, and July through September).

Finally, Extra Help eliminates any Part D late enrollment penalty (LEP) you may have if you delayed Part D enrollment. Remember that Extra Help is not a replacement for Part D or a plan on its own: You must still have a Part D plan to receive Medicare prescription drug coverage and Extra Help assistance.

If you do not have Medicaid, SSI, or an MSP, you can apply for Extra Help program through the Social Security Administration using either the print or online application (If you have Medicaid, SSI, or an MSP, you should automatically be enrolled). Be sure to complete the entire application and provide accurate information so you receive all the benefits for which you qualify.

State Pharmaceutical Assistance Programs (SPAPs)

State Pharmaceutical Assistance Programs (SPAPs) are programs offered by many states that can help residents pay for prescription drugs. Each program works differently.

States may coordinate their drug assistance programs with Part D. Some SPAPs require that you sign up for Part D coverage in order to qualify for assistance. In these cases, if a prescription drug is covered by both your SPAP and your Part D plan, both the amount you pay for your prescriptions plus the amount the SPAP pays will count toward the out-of-pocket maximum you have to pay before reaching catastrophic coverage.

Many SPAPs continue providing coverage during your Part D plan’s coverage gap. Your SPAP may also help pay for your Part D plan’s premium, deductible and copayments.

Certain states have qualified SPAPs. Qualified SPAPs provide a Special Enrollment Period (SEP) to allow you to enroll in or make changes to your Part D or Medicare Advantage coverage. Contact your State Health Insurance Assistance Program (SHIP) to find out if your state has an SPAP, if you may be eligible, and how to apply. If you do not know how to contact your SHIP, call 877-839-2675 or visit www.shiptacenter.org.

Assistance for Union Members

If you do not qualify for Extra Help or an SPAP, but want to save money on prescription drugs, check out the instant savings you or your family can enjoy through Union Plus. There is no cost to download and use the savings card as a union member at thousands of participating pharmacies nationwide.

If you need help in finding a Part D Medicare plan or have any questions about health plans available to you, please contact the Union Plus Retiree Health Insurance Program. The program has Medicare Insurance advisors who can help you compare plans and costs available to you among thousand nationwide. Call 1-888-719-0689 (TTY 711) Monday - Friday from 8 am to 8 pm EST to speak with a licensed insurance representative trained in dealing with union members or visit unionplusmedicare.org for more information.

*Much of this content is from the Medicare Rights Center.

Prescriptions don't always have to be expensive. Union members can get instant discounts on many medications through the Union Plus Prescription Discount program. As a Medicare beneficiary you can save on your medications even if you have limited income or no insurance. If you need assistance with a Medicare plan, please contact the licensed insurance advisors for the Union Plus Retiree Health Insurance Program at 888-719-0689 or at www.unionplusmedicare.com.

Tips for Buying a Car with Bad Credit

Living without a car can be difficult. But having bad credit often stops many buyers from purchasing a new - or even used - car. With all the financial and referential requirements, it may even seem like buying a car with bad credit is impossible.

Luckily, this is not the case. There are plenty of ways to buy a car with bad credit without breaking the bank. All it takes is a little research, patience, and smart decision making.

Consider What You Need

Bad credit scores aren’t the end of the world, but they do limit your options when it comes to buying a car. Therefore, it’s incredibly important to take stock of your needs before you start your search.

For example, you will want to consider your timeline, and if can you afford to spend a few months (or even years) working to increase your score. Evaluate the road conditions on your commute, including seasonal weather patterns. Think about your hobbies, especially if you are someone who enjoys the outdoors, and look at what sort of features you may need to accommodate your lifestyle. Dependability and safety are key for every buyer and avoid unnecessary luxuries.

Check Your Credit Score

After you’ve made a thorough inventory of your new-car requirements, check your credit score. Though there are free sites that can give you a rough estimation, your FICO Score is the most accurate. A FICO Score is a three-digit number that is broken down into five distinct categories. 35 percent of that number is determined by your payment history, 30 percent from your amounts owed, 15 percent from your length of credit history, 10 percent from your credit maximum, and 10 percent from new credit.

In general, a low credit score is considered anything below 650, while an excellent score is anything in the 720 to 850 range. Average is anything between those two numbers.

You should also get a copy of your credit report, which gives both you and the loan institution, bank, or credit union a more detailed report of your credit history. Credit reports show any missed payments, debts, and lines of credit.

If you have the luxury of time, do your best to up your credit game. Make a concerted effort to decrease your debt, pay bills promptly, and turn in your rent on time. Don’t make any unnecessary purchases and beef up your savings. If you haven’t already, prepare a detailed budget with reasonable expectations. Chances are, you’ll be making monthly payments for a few years, and you’ll want to be prepared for any unexpected life changes, illness, injury, or expenses.

Do Your Research

Taking your time to do some research will save you in the long run. Interest rates fluctuate, so you’ll want to investigate current rates to determine when might be the best time to buy.

As a low-credit customer, you will be most affected by these changes, and you’ll want to be prepared. If you need some extra assistance, use a car payment calculator. You’ll also want to find a reputable dealer. Ask people you know for recommendations, read reviews on crowd-sourced forums, and check out locations with a reliable friend.

Be wary of independent sellers, and always ask for Carfax and detailed maintenance records. You don’t want to commit to a car that will ultimately cost you in the long run.

The more you can contribute to your down payment, the better off you will be. Putting down at least 20 percent will not only show that you are serious about your purchase, but it will also lower your monthly payments, taxes, interest rates, and fees. And, if you end up needing to sell the car before you’ve paid it off, you’ll decrease your chances of owing more than it’s worth.

Avoid Bad Credit Auto Loan Companies

If you can, avoid opting in for in-house financing or loan companies that specialize in customers with low credit scores. These companies often take advantage of vulnerable customers by offering low monthly payments, then slapping on ludicrously high interest rates.

Your best bet for a fair loan will be your local bank or credit union. You know them, and they know you. Chances are, you’ve been with them for a while, and they can attest to your income and financial credibility more than a third-party institution.

You may also want to consider online companies. These institutions generally offer better rates than in-house financing and can sometimes give you more reasonable offers than local banks or credit unions. They don’t have the same overhead as places with physical locations, so they have the resources to give you better rates.

However, be judicious with your search if you decide to go the online payment route. Multiple inquiries can hurt your score, so make sure you are shopping within a very brief period, no more than a month.

If all else fails, consider getting pre-approved. Dealerships can do this for you but seek the assistance of your local bank or credit union first.

Last Minute Advice

On the whole, your loan experience should be well researched, risk-free, and give you the best deal for your financial and lifestyle needs. When it comes to making the final decision, don’t get caught up in an unbelievable deal; chances are, it’s too good to be true. Be wary of scams and read all of the paperwork meticulously before you finalize your commitment. If you are able to make a large down payment, submit your monthly payments promptly, and manage your personal budget accordingly, you will be able to slowly increase your credit score. Making solid, responsible decisions now will greatly improve your prospects of future investments.

© 2018 Money Management International

Take advantage of Union Plus Credit Counseling to create a plan of action to help you pay down your debt and get back on the road to financial recovery.

Article written by Haley Kieser. Haley covers financial, home, and auto topics for notable brands. She loves reading, writing, and saving money! After college, she paid off $29k in 1 year. She believes anything can be accomplished with a plan in place.

Buying a car with bad credit is not easy. There are steps you can take to boost your credit score and get the best deal on your new vehicle. Union Plus Credit Counseling provides a free consumer credit counseling session, budget analysis and money management advice. Union members can also save time and money with upfront pricing online, a free Carfax report for most vehicles, and rebates on new union made vehicles by using the Union Plus Auto Buying program.

Travel Guide: Five Secrets to Traveling Light

1. Limit your clothing options

Having multiple wardrobe options is a luxury the light traveler cannot afford. Instead, pack different pieces in the same color palette. You’ll be surprised at all the different ways a few items can work together. Bring simple jewelry and a scarf to add flair to your outfits.

2. Pack only two or three pairs of shoes

Limit yourself to just two or three pairs of shoes, always putting comfort first. Choose a good pair of walking shoes and one versatile dressy pair. Bring flip-flops if the pool or the beach is a possibility.

3. Travel sized toiletries

Purchase mini bottles (or reuse empty hotel shampoo bottles) to hold your essential products. Think about what you’ll be doing and only bring what you really need. Are four shades of lipstick really necessary? Probably not.

4. Bring a personal item bag

Personal item bags are allowed on airplanes in addition to a carry-on. Choose a large purse, small backpack or messenger bag to carry your phone charger, passport, wallet, snacks, water bottle and any other essentials.

5. Read eBooks

Physical books are heavy and take up a lot of space. Before taking off, download eBooks on your phone or tablet. You’ll be able to bring more while saving lots of space.

Packing for a trip can be a lesson in frustration. You intend to pack light, but that voice inside your head that says “I need all of this stuff!” can be pretty bossy. Collette tours has recently partnered with Union Plus to offer discounts on guided tours around the world. With 100 years of travel experience, their travel experts have shared these secrets to avoid over-packing for your next vacation.