Your November Financial To Do List

Even so, there are important steps you can take this month to put you in better financial stead, from learning ways to save money while shopping to making a number of end-of-year moves.

Here’s what should be on your financial to-do list:

Save on Shopping

This month, you may be able to save money when shopping online by understanding how retailers adjust their prices. More retailers now use dynamic pricing strategies—they shift their prices as they monitor competitors’ pricing and customer demand. Some even use what they know about your shopping habits and location to set the prices they show you.

There are steps you can take that may help you pay less, such as letting items sit in your shopping cart until the retailer drops the price to get you to buy. Another idea: Input a friend’s or relative’s ZIP code, or enlist someone in another ZIP code to shop for you. Prices may be lower than in your area.

There are also a number of digital tools you can use to save money while shopping. They range from browser extensions such as Invisible Hand to gift cards that sell for less than face value at sites like Raise or CardCash.

Take Your Required Minimum Distributions

If you have money in a tax-deferred retirement account such as a traditional 401(k) or IRA, and you’re over age 70 ½, taking a required minimum distribution before the end of the year should be on your financial to-do list.

The amount that you must withdraw is based on the amount of money you have in such accounts and your life expectancy, according to the IRS. Note that you will also have to pay taxes on this income when you file in April.

Failing to take your required minimum distribution can be costly: You’ll owe the IRS a penalty that comes to half of the amount that should have been withdrawn. It’s a smart idea to get in touch with your financial adviser now to figure out how much money you need to withdraw.

If your money is in a Roth IRA, you won’t need to add this to your financial to-do list. Roth IRAs are not subject to minimum distributions. You are also not required to take a distribution from a 401(k) with an employer for which you currently work.

Plan Your Charitable Contributions

Giving money to important causes is in keeping with the spirit of the holidays, and doing so before year-end can give you an extra write-off at tax time. Before sending in money, run a check of the organization you plan to contribute to via sites like Charity Navigator and GuideStar. These watchdogs, as they are known, offer reviews from donors as well as data on how much of the contributions you make go directly to the cause. (For local or regional charities, check the BBB Wise Giving Alliance.) When you do give, be sure to save the receipt so that you have it at tax time.

Visit Your Doctor

If you still have money in a medical flexible-spending account at work, put this on your financial to-do list: Start spending it down. Although many companies now offer a grace period into next year, you’ll forfeit any money you haven’t spent once that period expires. Take the opportunity to make doctor’s appointments that you’ve been putting off, or to schedule a flu shot if you haven’t had one yet. November is the slowest month of the year for doctors, according to Zocdoc, a website that helps you to find a doctor and make medical appointments online. So you should be able to get a convenient appointment with a reasonable wait time.

Note: If your money is in a health spending account (an HSA rather than an FSA), the unused balance will roll over to next year.

Buy Items on Deep Discount

In addition to the savings you’ll get on Black Friday and Cyber Monday, November is a great time to get a discount on televisions and toys.

Research by Consumer Reports product experts, who track prices year-round, shows that November is an ideal time to get a good deal on coffee makers and refrigerators. The cooler weather means you may also be able to get a good deal on leftover bikes and gas grills, which retailers need to move out of their stores.

Copyright© 2006-2017 Consumer Reports, Inc. of U.S., Inc. No reproduction, in whole or part, without written permission.

In just a few weeks, the holiday shopping season will officially start with sales during Black Friday—the day after Thanksgiving—and Cyber Monday. It’s also the time of year when you’re likely to be more focused on traveling and social get-togethers.

10 Things You Can Do to Avoid Fraud

- Spot imposters. Scammers often pretend to be someone you trust, like a government official, a family member, a charity, or a company you do business with. Don’t send money or give out personal information in response to an unexpected request — whether it comes as a text, a phone call, or an email.

- Do online searches. Type a company or product name into your favorite search engine with words like “review,” “complaint” or “scam.” Or search for a phrase that describes your situation, like “IRS call.” You can even search for phone numbers to see if other people have reported them as scams.

- Don’t believe your caller ID. Technology makes it easy for scammers to fake caller ID information, so the name and number you see aren’t always real. If someone calls asking for money or personal information, hang up. If you think the caller might be telling the truth, call back to a number you know is genuine.

- Don’t pay upfront for a promise. Someone might ask you to pay in advance for things like debt relief, credit and loan offers, mortgage assistance, or a job. They might even say you’ve won a prize, but first you have to pay taxes or fees. If you do, they will probably take the money and disappear.

- Consider how you pay. Credit cards have significant fraud protection built in, but some payment methods don’t. Wiring money through services like Western Union or MoneyGram is risky because it’s nearly impossible to get your money back. That’s also true for reloadable cards like MoneyPak, Reloadit or Vanilla. Government offices and honest companies won’t require you to use these payment methods.

- Talk to someone. Before you give up your money or personal information, talk to someone you trust. Con artists want you to make decisions in a hurry. They might even threaten you. Slow down, check out the story, do an online search, consult an expert — or just tell a friend.

- Hang up on robocalls. If you answer the phone and hear a recorded sales pitch, hang up and report it to the FTC. These calls are illegal, and often the products are bogus. Don’t press 1 to speak to a person or to be taken off the list. That could lead to more calls.

- Be skeptical about free trial offers. Some companies use free trials to sign you up for products and bill you every month until you cancel. Before you agree to a free trial, research the company and read the cancellation policy. And always review your monthly statements for charges you don’t recognize.

- Don’t deposit a check and wire money back. By law, banks must make funds from deposited checks available within days, but uncovering a fake check can take weeks. If a check you deposit turns out to be a fake, you’re responsible for repaying the bank.

- Sign up for free scam alerts from the FTC at ftc.gov/scams. Get the latest tips and advice about scams sent right to your inbox.

If you spot a scam, report it at ftc.gov/complaint. Your reports help the FTC and other law enforcement investigate scams and bring crooks to justice.

Originally posted by the Federal Trade Commission. All rights reserved.

Crooks use clever schemes to defraud millions of people every year. They often combine new technology with old tricks to get people to send money or give out personal information. Here are some practical tips to help you stay a step ahead.

Seven Keys to Avoiding Post-Disaster Scams

Unfortunately, the turmoil that rises up in the wake of a major disaster is also a prime breeding ground for scams and scam artists. These crooks take advantage of the anguish and confusion surrounding a major misfortune and use it to twist our fears and sympathy to their advantage. Fortunately, there are a few key ways you can protect yourself from the sort of scams that tend to pop up during and after a disaster.

Remember that anyone can call you or send you mail

A large portion of the most successful scams start simply with a phone call or a piece of mail. The people calling sound authoritative and the mail looks authentic, so you go along with what you’re being told. That’s why it bears remembering that anyone can call you and anyone can cobble together an official-looking piece of mail. Avoid assuming that just because someone seems credible, that they are.

Independently verify everything

If someone calls and tells you that you need to make a payment immediately in order to maintain your flood coverage (a popular scam that cropped up again in the aftermath of Hurricane Harvey’s record rainfall), hang up the phone and check with your insurer directly. Don’t use any phone number provided via robocall or unsolicited mail. Use the phone number provided on your monthly bill or find one directly on your insurer’s website.

Scammers will always try to keep you inside their loop by providing you with phone numbers, mailing addresses, email addresses, and website links that they control. If you’re ever suspicious, be sure to independently verify what you’re being told.

Legitimate services will almost never pressure you to take any action immediately

Many scams work because they prey on our fears – that if we don’t do what we’re told to do, something terrible might happen. That fear is only increased during a disaster, when terrible things are already happening and we’re just trying to minimize the damage.

If someone is telling you that you need to act now, chances are good they’re trying to prevent you from verifying whether or not they’re a legitimate business or service. Don’t let the pressure get to you.

Never make payments or give out personal information on a phone call you didn’t initiate

There may be a legitimate charity or business calling you directly and asking you to make a payment, but the odds are against it. Your safest bet is always to avoid making payments or providing crucial personal information over the phone or through email. If you do need to do either, at least make sure you’re the one who started the call. You’re highly advised to never include confidential information in an email – if you need to submit that kind of information online, make sure you’re using a secure site (the web address should begin with https).

Be wary of anyone going door-to-door

Scammers have been known to pose as contractors, charity workers, or even government officials, and unfortunately fake uniforms and ID cards can be pretty convincing. Just keep in mind that if anyone is trying to sell you something or looking for a donation, you can say no and then do the necessary research. You should be especially wary of anyone asking for full payment upfront on any service. Also, no government employee should be asking you for payment or confidential financial information before providing a benefit or service.

Stick with charities and services you know and trust

One of the best ways to protect yourself is to simply stick with the charities and businesses you’re already familiar with. That isn’t to say you can’t give to new charities or use new businesses, but the best research is usually firsthand. At the very least, lean on services with an established track record. If you can’t verify that the charity or business in question in credible, chances are good you can easily find an alternative that is.

Document everything

Even when dealing with legitimate businesses and charities, things can go awry. When hiring someone to perform any sort of service, make sure that

- They’re qualified and you’ve seen any licenses or certifications required by their field;

- They provide you with an estimate upfront, followed by a written agreement detailing what work will be done by when and at what price;

- You confirm with your insurer that any work that’s supposedly covered by your insurance actually is; and

- You pay with a credit card whenever possible. Paying with a credit card gives you the ability to reverse any fraudulent charges, adding an extra layer of protection.

Good recordkeeping doesn’t guarantee that you’ll avoid any and all potential scams, but it will make things much easier to untangle in the event someone tries to take advantage of you.

Good luck and stay safe!

Union Plus Credit Counseling

Union members can get a no-obligation money and credit assessment from certified, experienced consumer credit counselors though Union Plus Credit Counseling. Powered by the non-profit Money Management International (MMI), your free session will cover a complete financial review, assistance in budgeting, advice for working with creditors, and more.

As we’ve seen time and time again, disasters have a tendency to bring out the best in us. From neighbors helping neighbors, to foreign countries sending aid, catastrophe has a way of bringing people together.

The Equifax Data Breach: What to Do

Here are the facts, according to Equifax. The breach lasted from mid-May through July. The hackers accessed people’s names, Social Security numbers, birth dates, addresses and, in some instances, driver’s license numbers. They also stole credit card numbers for about 209,000 people and dispute documents with personal identifying information for about 182,000 people. And they grabbed personal information of people in the UK and Canada too.

There are steps to take to help protect your information from being misused. Visit Equifax’s website, www.equifaxsecurity2017.com.

- Find out if your information was exposed. Click on the “Potential Impact” tab and enter your last name and the last six digits of your Social Security number. Your Social Security number is sensitive information, so make sure you’re on a secure computer and an encrypted network connection any time you enter it. The site will tell you if you’ve been affected by this breach.

- Whether or not your information was exposed, U.S. consumers can get a year of free credit monitoring and other services. The site will give you a date when you can come back to enroll. Write down the date and come back to the site and click “Enroll” on that date. You have until November 21, 2017 to enroll.

- You also can access frequently asked questions at the site.

Here are some other steps to take to help protect yourself after a data breach:

- Check your credit reports from Equifax, Experian, and TransUnion — for free — by visiting annualcreditreport.com. Accounts or activity that you don’t recognize could indicate identity theft. Visit IdentityTheft.gov to find out what to do.

- Consider placing a credit freeze on your files. A credit freeze makes it harder for someone to open a new account in your name. Keep in mind that a credit freeze won’t prevent a thief from making charges to your existing accounts.

- Monitor your existing credit card and bank accounts closely for charges you don’t recognize.

- If you decide against a credit freeze, consider placing a fraud alert on your files. A fraud alert warns creditors that you may be an identity theft victim and that they should verify that anyone seeking credit in your name really is you.

- File your taxes early — as soon as you have the tax information you need, before a scammer can. Tax identity theft happens when someone uses your Social Security number to get a tax refund or a job. Respond right away to letters from the IRS.

Visit Identitytheft.gov/databreach to learn more about protecting yourself after a data breach.

Originally posted by the Federal Trade Commission. All rights reserved.

If you have a credit report, there’s a good chance that you’re one of the 143 million American consumers whose sensitive personal information was exposed in a data breach at Equifax, one of the nation’s three major credit reporting agencies.

Warning Signs of Identity Theft

What Do Thieves Do With Your Information?

Once identity thieves have your personal information, they can drain your bank account, run up charges on your credit cards, open new utility accounts, or get medical treatment on your health insurance. An identity thief can file a tax refund in your name and get your refund. In some extreme cases, a thief might even give your name to the police during an arrest.

Clues That Someone Has Stolen Your Identity

- You see withdrawals from your bank account that you can’t explain.

- You don’t get your bills or other mail.

- Merchants refuse your checks.

- Debt collectors call you about debts that aren’t yours.

- You find unfamiliar accounts or charges on your credit report.

- Medical providers bill you for services you didn’t use.

- Your health plan rejects your legitimate medical claim because the records show you’ve reached your benefits limit.

- A health plan won’t cover you because your medical records show a condition you don’t have.

- The IRS notifies you that more than one tax return was filed in your name, or that you have income from an employer you don’t work for.

- You get notice that your information was compromised by a data breach at a company where you do business or have an account.

If your wallet, Social Security number, or other personal information is lost or stolen, there are steps you can take to help protect yourself from identity theft.

Originally published by the Federal Trade Commission. All rights reserved.

If you discover that someone is misusing your personal information, visit IdentityTheft.gov to report and recover from identity theft.

Five Reasons You Make Plenty of Money and Still Feel Broke

You make good money and you don’t think your expenses are unreasonable, but at the end of the month there’s nothing left over. You aren’t falling behind, but you aren’t getting ahead either. Something seems off.

So what gives? If you have plenty of income, why aren’t your finances coming together like you think they should? There are a few possible reasons.

You aren't paying attention

It sounds simple enough, but many spending problems start small and then balloon over time because we just aren’t paying attention. When we have money, we’re much less likely to budget carefully or really stop to consider our purchases. Why would you, if you know you can afford it?

The trouble, of course, is that just because these purchases don’t cause us any pain at the time we make them, doesn’t mean they don’t eventually catch up to us. Today’s half-considered purchase is the reason there’s no money left over at the end of the month. Start paying attention by tracking your purchases. Review your spending regularly and ask yourself, “What of these things did I really need?”

Your wants are louder than your needs

You probably already know that smart budgeting requires the ability to separate wants from needs. The trouble is that this isn’t necessarily as easy as it sounds.

When we get used to certain wants, they start to feel an awful lot like a need. This is a power of a habit. Something becomes a part of your routine and you don’t just want it – you need it. This is why buying a $5 coffee at Starbucks by itself is not an issue. Once it becomes a daily habit, however, and it starts to feel essential, then it’s a problem and you need to work on rewiring your bad habits.

You’re overpaying for convenience

If you can afford it, there are quite a few things you never have to actually do for yourself. And if you’re interested in saving time, there are plenty of ways to spend money and save time. After a while, however, you may find yourself leaning a little too heavily on these conveniences, which can be financially distressing, even if you have the income to support it.

If you’re overspending on convenience, a good trick is to try and always remember what it feels like when you reach the end of the month and there’s little to no money left over. What’s that feeling? Disappointment? Worry? Anxiety? Frustration? Find that feeling and hold on to it. Then, when you’re trying to decide if you should eat in or dine out (for example), weigh those negative feelings against whatever momentary positive feelings you may get from taking the more convenient, but more expensive option. If the desire to stop feeling anxious about money outweighs your desire to not have to cook dinner tonight, you’ll find it’s much easier to make a change.

You actually can’t afford the things you buy

If there’s a danger to being financially comfortable, it’s how easily that can turn into financial complacency. When you have a more than adequate income, your sense of financial scale can be thrown off. You don’t hesitate to buy a brand new car with all the upgrades or buy a nice home on the good side of town because, in your mind, you can afford it.

But just because you have the money, doesn’t necessarily mean that you can afford it. There’s a reason nearly one-third of all lottery winners end up declaring bankruptcy – no amount of money is infinite. What you spend today is not available to spend tomorrow. That may seem obvious, but spending money has never been easier than it is today. You don’t need to hand over cash, write a check, or even swipe a credit card anymore. Unless you’re actively budgeting yourself, it’s very easy to get the wrong idea about your money.

The trick is to train yourself to see the bigger picture. A top of the line car may be affordable, but where else could some of that money be going? Try to understand what your financial priorities are and let those priorities guide you when spending money you could otherwise be saving.

You don’t know what you really want

Most financial problems boil down to this feeling: “I am Here, but I feel like I should be There.” After all, if you think things are fine as they are, then there’s no problem, right? But what if you don’t know what “There” looks like? What if you only know that “Here” isn’t cutting it?

That can be a very debilitating problem. It’s incredibly difficult to make positive changes when there’s no plan, and it’s even harder to create a good plan when there’s no goal. If you’re feeling stuck, a big part of that may be because you don’t know what it is you really want.

That’s okay, of course. But in the interim, you might want to consider creating a starter goal – something to get you moving, even if it ends up changing somewhere along the way. It can be small and short-term, but it should be concrete rather than abstract. Once you have a goal to work towards, some of these other problems become much easier to identify and manage. But it all starts with a goal.

If you need help finding your starting point, considering speaking with a budgeting counselor from MMI. We understand what it feels like to feel stuck, and we can suggest resources and next steps to start you moving in the right direction.

Union Plus Credit Counseling

Union members can get a no-obligation money and credit assessment from certified, experienced consumer credit counselors though Union Plus Credit Counseling. Powered by the non-profit Money Management International (MMI), your free session will cover a complete financial review, assistance in budgeting, advice for working with creditors, and more.

There are any number of reasons why money becomes a problem, though they tend to boil down to two basic options: too many expenses or too little income. Sometimes, however, neither is really the case.

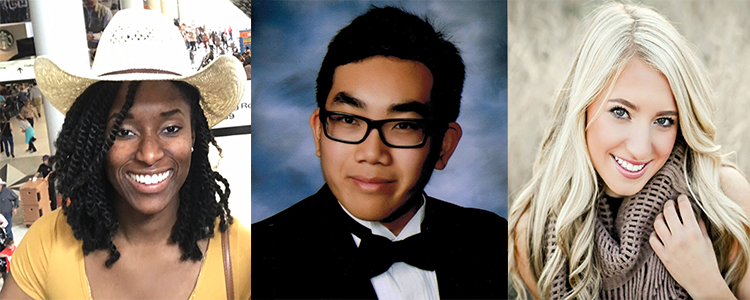

2017 Union Plus Scholarships Award $150,000 to Union Members and Families

The Union Plus Scholarship Program, now in its 26th year, awards scholarships based on outstanding academic achievement, personal character, financial need and commitment to organized labor's values. The program is offered through the Union Plus Education Foundation, supported in part by contributions from the provider of the Union Plus Credit Cards. Applicants do not need to be a credit cardholder to apply for the scholarship.

Since starting the program in 1991, Union Plus has awarded more than $4.2 million in educational funding to more than 2,800 union members, spouses and dependent children. Union Plus Scholarship awards are granted to students attending a two-year college, four-year college, graduate school or a recognized technical or trade school. The selection process is very competitive and this year over 5,100 applications were received from 65 unions, all 50 states, plus the District of Columbia and three U.S. territories. Visit unionplus.org/scholarship for applications and information about benefit eligibility.

"Education is a vital building block for success," said Mitch Stevens, Union Plus president. “We’re pleased to be helping some of the labor movement’s most promising students achieve their college dreams.”

In addition to the scholarship program, Union Plus provides a wide range of money-saving programs and services for union members and families, including discounts on wireless services from AT&T, the only nationwide unionized wireless carrier, savings on travel and recreation, and more. Union Plus also offers a credit card program1 and mortgage program, both of which feature Hardship Assistance Grants2 for eligible participants. Visit unionplus.org for details.

1Credit approval required. Terms and conditions apply. See www.theunioncard.com for details. Union Plus Credit Cards are issued by Capital One, N.A. pursuant to a license from Mastercard International Incorporated.

2Certain restrictions, limitations and qualifications apply to these grants. Additional information and eligibility criteria can be obtained at UnionPlus.org/Assistance.

Union Plus recently awarded $150,000 in scholarships to 106 students representing 31 unions. This year’s group of scholarship recipients includes university, college and trade or technical school students from 35 states.

IRS Imposter Scams: How to File a Complaint

No. The real IRS doesn't call and if they do contact you about unpaid taxes, they do it by mail, not by phone.

Here’s what you can do:

- Stop. Don’t wire money or pay with a prepaid debit card. Once you send it, the money is gone. If you have tax questions, go to irs.gov or call the IRS at 800-829-1040.

- Pass this information on to a friend. You may not have gotten one of these calls, but the chances are you know someone who has.

Please Report Scams

If you believe you've been the victim of an IRS scam, please report it to the Treasury Inspector General for Tax Administration.

Originally published by USAGov. All rights reserved.

You get a call from someone who says he's from the IRS and tells you that you owe back taxes. These call usually involve threats for immediate payment. The caller may know part of your Social Security number. And your caller ID might show a Washington, DC area code. But is it really the IRS calling?

Seven Simple Ways to Reduce Money Stress

That’s why it’s not surprising to learn that half of all young adults in America (aged 25 to 34) believe that worries about money have a negative impact on their health. Even in a perfect economy, there will always be something to worry about, and that stress can be damaging – in more ways than one. That same survey found that 53 percent of young adults felt that money stress had negatively impacted their personal relationships.

Money stress is normal, and while you can’t avoid it entirely, there’s a lot you can do to manage and overcome it.

Don’t Ignore It

Try to avoid pretending that the stress you’re feeling isn’t there. Denying your worries or acting as though they aren’t justified will only make matters worse. Recognize that you’re stressed and that it’s okay to feel that way. After all, it’s very difficult to solve a problem if you refuse to accept that you have one.

Talk About It

No matter what specific issue is causing you stress, you are almost certainly not alone. There is tremendous value in simply sharing your experiences – your fears and personal pains – with sympathetic friends and others dealing with similar problems. It’s a great way to relieve some of your burden, put your problems into perspective, and see how others have dealt with similar situations.

Never Stop Doing Positive Things for Yourself

If you’re stressed about money, there’s a good chance you’ve stopped doing a lot of things you might otherwise be doing. Money woes can often cause us to freeze up out of fear of making things worse, or because we feel like we don’t “deserve” to have fun.

While it’s definitely a good idea to be cautious with your money when you’re feeling financial pressure, you should absolutely continue to do positive, fulfilling things for yourself. You should eat right, stay connected socially, and take care of your mental health. Do your best to avoid letting money problems spread to other parts of your life.

Stay Active

Staying physically active is an enormously effective way to battle through any kind of stress. If money has you tied up in knots, go for a walk. It costs nothing and can go a long way towards making you feel better.

Keep Learning

Money stress usually derives from either a lack of income, a wealth of debt, or some combination thereof. Understanding how to better manage money, how to shop smarter, how to use credit wisely, and how to build your savings – among other topics – can help you feel more in control of your finances, which will go a long way towards relieving your stress.

Take Active Steps to Make Things Better

Perhaps the most important way to reduce money stress is to attack the root cause of that stress. Strive to understand the core problem. If you have too much credit card debt, how did that happen? If it’s because you spend more than you can afford, try to understand the motivation behind that behavior. There’s probably a feeling or emotional motivator a couple layers below the more obvious surface problem. Try to figure out what really happened and take active steps to change your behavior and create a less stressful situation for yourself.

If you’re stressed about your income, consider what it might take to get a raise, move into a higher paying job, or add a second income. If you have more debt than you can handle, consider working with a debt and budget specialist or inquiring about a debt consolidation loan. Try to find the solution that works for you and make continuous progress towards those goals.

Try to Maintain Perspective

If you’re feeling really overwhelmed with money worries, try to take a step back and maintain perspective. There’s almost always a solution, and while things may feel dire right now, chances are good that if you find the right plan and do the necessary work, you can put yourself in a much better place.

Union Plus Credit Counseling

Union members can get a no-obligation money and credit assessment from certified, experienced consumer credit counselors though Union Plus Credit Counseling. Powered by the non-profit Money Management International (MMI), your free session will cover a complete financial review, assistance in budgeting, advice for working with creditors, and more.

Learn More

It’s hard not to have money on your mind. In good times and especially bad times, money is a constant source of consideration and concern.

Three Counterintuitive Ways to Save Money

Shop for Groceries More Often

Common sense seems to dictate that the less shopping you do, the more money you save. While that may be true in most instances, it may not be the case for you, especially if you’re not great at setting a schedule and sticking to it. If you have an issue wasting food (which is statistically probable, given that nearly one-third all food produced in the world ends up going to waste), long-term grocery planning may not be your strong suit. And that’s fine! I personally find that when I try to plan meals out for an entire week, things inevitably go awry and something goes to waste. So instead, I tend to shop in four day cycles. This makes it easier to invest in fresh produce and helps ensure I use up everything I bought.

Invest in Quality

When you’re trying to save money, the less expensive option will always look the most appealing. Cheaper, older, secondhand – however you get there, if it costs less, it will almost always jump to the head of the line.

But cheaper rarely means better, and a dollar saved today could cost you five times over in the future. That’s why spending more for higher quality can often be such a worthwhile, money-saving investment. From mattresses to dress shoes, when you invest in high quality goods, it can save you money in the long run. You can and should still be choosey, of course. Do plenty of research and price comparison before making your selection.

Plan to Splurge

Unplanned expenses can be budget-busters, and unplanned splurges can be even more damaging. When you’re living on a tight budget or trying to save money, you may feel routinely tempted to break from your frugal lifestyle and splurge. That’s natural – the more constricted your spending is, the more you’re going to feel that desire to buy something.

Rather than running away from those urges, consider working them into your spending plan. In much the same way that athletes on a strict diet allow themselves to have a “cheat day”, you can build a planned splurge into your budget. You don’t have to plan out your purchase, just leave a space in your budget – once a month or once a paycheck – and use those funds to “cheat”. By having your splurge planned out, you scratch that itch, but you’re prepared for it and your budget is designed to support it.

Union Plus Credit Counseling

Union members can get a no-obligation money and credit assessment from certified, experienced consumer credit counselors though Union Plus Credit Counseling. Powered by the non-profit Money Management International (MMI), your free session will cover a complete financial review, assistance in budgeting, advice for working with creditors, and more.

There are plenty of good ways to save money, many of them pretty obvious. Get rid of cable TV; eat out less; turn off the lights when you’re not in the room, etc. There are also a few slightly less obvious ways to save – ways that may even seem a little backwards at first glance.