Find consumer tips on everything from credit to home safety to travelling on a budget and so much more!

Pet Accidents Increase in Summer Months

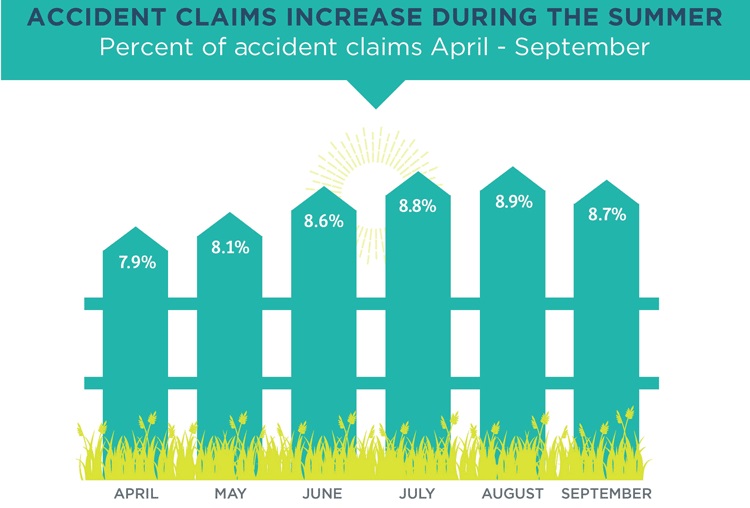

The average accident claim from April through September ranged from $535 - $590.* Below is the percentage of Pets Best claims that were associated with an accident during these months:

- April: 7.9%

- May: 8.1%

- June: 8.6%

- July: 8.8%

- August: 8.9%

- September: 8.7%

Having pet insurance can help take the sting out of those expensive veterinary bills so that your summertime fun isn’t squashed financially.

Pets Best paid over $3.2 million in pet insurance claims just for accidents April-September (2015-2017).

Accident plans are only $6/month for cats and $9/month for dogs (prices vary in WA).** If you’d like illness coverage as well, there is the more comprehensive BestBenefit Accident and Illness Plan.

Learn more about the

Union Plus Pet Insurance program

*Based on Pets Best accident claims data from 2015, 2016 and 2017.

**In WA state: the Accident Plan is $10/mo for dogs and $7/mo for cats and the EssentialWellness plan is $14/mo. The 5% multi-pet discount is available in all states on the BestBenefit Accident and Illness Plans only; and in WA state it is available on all plans.

Pet insurance coverage offered and administered by Pets Best Insurance Services, LLC is underwritten by American Pet Insurance Company.

The percent of accident claims Pets Best receives, rises during the warm weather months. We’re more active with our pets during the summer so the likelihood of an accident or injury naturally increases. From camping and hiking, water sports, road trips, and barbecues at friends’ houses, our pets are there for it all.

Buy Your Home With Little To No Money Down

Low down payment options include:

• yourFirst Mortgage® benefits first- and next-time homebuyers with 3% down payment option on a fixed-rate loan. We’ll help determine eligibility factors — like loan amount, type of loan, and property type. Just keep in mind that with a low down payment, mortgage insurance is required and will increase your monthly payment.

• FHA loans have the benefit of a low down payment of 3.5%, though you’ll want to consider all costs involved, including upfront and long-term mortgage insurance and all fees.

• VA loans benefit active duty or veteran military service members and eligible spouses by offering low or no payment requirements that also includes a white range of rate, term and cost options. Mortgage insurance is not required.

• Homebuyer assistance programs benefit those with modest income or first-time homebuyers who have certain obstacles to overcome which include:

- Down payment Assistance Programs help cover the gap between the loan amount the homebuyer qualifies for and the amount they have available for the down payment. They’re provided in specific communities and may be administered by a state, county, city, governmental coalition, or non-profit organization.

- Mortgage Revenue Bonds provide mortgage financing with low or below market interest rate options, and can often be combined with down payment assistance programs.

Plus if you close a loan through the Union Plus Mortgage program, you’ll be eligible for special benefits that include receiving a My Mortgage GiftSM award from Wells Fargo - $500 for buying a home or $300 for refinancing your home – for use at participating retailers and access to mortgage assistance through Union Plus in times of hardship such as layoff, disability or strike.1 Keep in mind that parents and children of union members are also eligible for certain benefits.

While each program can provide benefits up front, it’s important to determine if there are any long term considerations such as mortgage insurance that may increase your overall monthly payments. There may also be income, credit restrictions or homebuyer education requirements to be eligible. Our home mortgage consultants will help you compare overall costs and help determine if you qualify.

How can I save for a down payment?

It's never too early to start saving. To help you identify your need-to-haves, cut back on nice-to haves, and put aside money you’ll need to buy a home, you can take advantage of our online budgeting and savings tools. You could also set up a separate “first home” savings or investment account and have a set amount directly deposited into it every month. The set amount could be automatically deducted from the account where you deposit your paycheck or other income.

Want to learn more?

Click here to learn more about the Union Plus Mortgage program, talk to a Union Plus Mortgage Specialist at 866-802-7307 or request a personal consultation.

1. Eligible individuals can receive the Wells Fargo My Mortgage GiftSM award approximately 6 weeks after closing on a new purchase or refinance loan secured by an eligible first mortgage or deed of trust with Wells Fargo Home Mortgage (“New Loan”), subject to qualification, approval and closing, when identifying themselves as eligible. The My Mortgage GiftSM award is not available with any Wells Fargo Three-Step Refinance SYSTEM® program, The Relocation Mortgage Program® or to any Wells Fargo team member. Only one My Mortgage Gift award is permitted per eligible (“New Loan”). This award cannot be combined with any other award, discount or rebate, except for yourFirstMortgageSM. This award is void where prohibited, transferable, and subject to change or cancellation with no prior notice. Awards may constitute taxable income. Federal, state and local taxes, and any use of the award not otherwise specified in the Terms and Conditions (also provided at receipt of award) are the sole responsibility of the My Mortgage GiftSM recipient.

Information is accurate as of date of distribution. Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. © 2018 Wells Fargo Bank, N.A. All rights reserved. NMLSR ID 399801 ![]()

If you’re looking to buy a home, you may not need a 20% down payment or perfect credit. Through the Union Plus® Mortgage program, with financing provided by Wells Fargo Home Mortgage, union members, their parents and children have access to a wide range of home loan options to meet a variety of needs, including access to low down payment programs for qualified borrowers.

How Credit Checks Affect Buying a Home

You probably know that your credit score is something that all mortgage companies will look at when you apply for a loan. But, how does your credit score and credit checking actually affect buying a home? Here are a few of the basic things to know before you apply for a mortgage.

Why Do Lenders Look at Credit Scores?

Lenders will request access to your credit score because it’s an indication of how well you’ll pay back a loan. It tracks all sorts of factors related to your history of paying back credit cards and debt.

What’s an Acceptable Credit Score?

- < 630 = Low Credit

You might have a credit score of 630 or less if you’ve had issues with bankruptcy, a history of missed payments or if you don’t have any credit history.

- 630 – 689 = Fair Credit

This is an average credit score. It tells the lender that you do not have too much bad debt. You might want to consider paying down credit cards and/or ensure you’re always paying your debts on time.

- 690 – 719 = Good Credit

You will be an ideal candidate for most loans and shouldn’t worry about being penalized for your credit score.

- 720 – 850 = Excellent Credit

You will get the best rates available as a reward for paying down your debts on time and not having any history of issues.

How Does Checking My Credit Score Affect My Score?

There are two types of inquiries — soft and hard. Hard inquiries are the only type that affect your credit score.

When you apply for credit, a lender or credit card company checks your credit score, which is considered a hard inquiry. A hard inquiry will typically lower your credit score by a few points and will stay on your credit report for two years.

Soft inquiries, like when a person or company checks for your credit score, should not affect your score.

How Does My Score Affect Getting a Home?

Most mortgage companies will look at your credit as a way to determine your interest rate and the types of products available to you. The better your score the lower the interest rate and the more product options you will have. Knowing your credit score and ensuring there aren’t any outstanding issues associated with it, could end up saving you thousands when applying for a mortgage.

You are eligible for a free credit report each year, so before you apply for a mortgage check first to see if there are any issues or disputes that need to be addressed.

And, as always, when you find that perfect home — don't forget the Union Plus Real Estate Rewards and the Union Plus Mortgage Program to help you with your home buying process.

Your credit score significantly affects the outcome of your home loan application. There are ways to check your score without dinging your credit score.

Home Financing Tools: Before you Own, While You’re Buying and After You’ve Purchased

With a little planning and research, you can build your homebuying knowledge and have more confidence as you prepare to buy a home. Through the Union Plus® Mortgage program, with financing provided by Wells Fargo Home Mortgage, union members, their parents and children will have access to a variety of resources to prepare for homeownership.

Before You Buy

With our online tools, you can quickly see how much you may be able to borrow, while also having access to:

- Check today’s rates.

- Compare loan options — including features, interest rates and payments.

- Home Loan Calculators — calculate rates and payments and explore how much you may be able to borrow

- Learning resources — to help you understand the homebuying and mortgage process.

- Get prequalified — have us contact you to see how much you may be able to borrow.

When You’re Ready to Apply

- Apply online with a simplified mortgage application. You can choose to connect the application with your financial accounts and easily upload documents. Contact us to learn more.

- Whether you’re at home or on-the-go, know where you’re at in the home financing process with yourLoanTrackerSM. See your loan's progress any time from your computer, smartphone, and tablet.1 And, from beginning to end, your home mortgage consultant will be there to guide you. yourLoanTracker is not available with all loans; talk to a home mortgage consultant for details.

After You Close

When you close your mortgage with Wells Fargo Home Mortgage, you’re journey with us doesn’t end. We have a variety of tools and resources to help you once you’re in your home.

- Online payment options including our free Preferred Payment PlanSM option where you can schedule automatic payments timed to match your paycheck cycle.

- Escrow accounts — learn how escrow accounts work and how they can change your payments.

- Disaster Assistance and Property Damage Support — whether a widespread disaster or some other event has damaged your home, our disaster assistance team is here to help.

- Help with payment challenges — we're here to help if you experience trouble making payments.

And remember, after closing on a loan through the Union Plus Mortgage program, you’ll be eligible for special benefits that include receiving a My Mortgage GiftSM award from Wells Fargo — $500 for buying a home or $300 for refinancing your home, for use at participating retailers — and access to mortgage assistance through Union Plus in times of hardship such as layoff, disability or strike.2,3 Keep in mind that parents and children of union members are also eligible for certain benefits.

Click here to learn more about the Union Plus Mortgage program, talk to a Union Plus Mortgage Specialist at 866-802-7307 or request a personal consultation.

1Availability may be affected by your mobile device's coverage area.

2Eligible individuals can receive the Wells Fargo My Mortgage GiftSM award approximately 6 weeks after closing on a new purchase or refinance loan secured by an eligible first mortgage or deed of trust with Wells Fargo Home Mortgage (“New Loan”), subject to qualification, approval and closing, when identifying themselves as eligible. The My Mortgage GiftSM award is not available with The Relocation Mortgage Program® or to any Wells Fargo team member. Only one My Mortgage Gift award is permitted per eligible New Loan. This award cannot be combined with any other award, discount or rebate, except for yourFirstMortgageSM. This award is void where prohibited, transferable, and subject to change or cancellation with no prior notice. Awards may constitute taxable income. Federal, state and local taxes, and any use of the award not otherwise specified in the Terms and Conditions (also provided at receipt of award) are the sole responsibility of the My Mortgage GiftSM recipient.

3The Union Plus® Mortgage Assistance Program is provided and administered through the AFL-CIO Mutual Benefit Plan (“The Plan”), which is not affiliated with Wells Fargo Bank, N.A. Additional information about this program and eligibility criteria can be obtained at www.unionplus.org/assistance.

Wells Fargo Home Mortgage has a services agreement with Union Privilege in which Union Privilege receives a financial benefit for providing agreed upon services. You are encouraged to shop around to ensure you are receiving the services and loan terms that fit your home financing needs.

Union Plus® is a registered trademark of Union Privilege.

Information is accurate as of date of distribution. Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. © 2018 Wells Fargo Bank, N.A. All rights reserved. NMLSR ID 399801

The Union Plus Mortgage Program offers union members exclusive benefits when purchasing a home. Use these online tools to be prepared and save money when purchasing your new home.

Union Tips for U.S. Trips: Union Monuments

Check out this list of union sites around the country!

- Amtrak Workers’ Memorial — Washington, DC

Memorial that honors those Amtrak employees who lost their lives in performance of their duties.

Fun fact: The Amtrak Workers' Memorial is located in Washington, DC's Union Station.

- Memphis Strike of 1968 Monument — Memphis, TN

This gallery expands the story of the 1968 Memphis sanitation strike. Features exhibits and videos highlighting Rev. James Lawson and T.O. Jones, who courageously waged the battle on behalf of striking sanitation workers.

Fun fact:The iconic "I Am a Man" signs held by strikers and the garbage truck from the original exhibition can be found here.

- Haymarket Martyrs Memorial — Chicago, IL

On May 4, 1886, what began as a peaceful rally to protest unfair working conditions erupted into violence after a man threw a bomb at police, resulting in injuries and deaths among both protesting workers and police officers. Eight union activists were wrongfully accused, convicted and hanged. This monument is a reminder of the lives lost during the fight for workers rights.

Fun fact: Visitors often leave union buttons, flowers and other tokens at the base of the monument.

- Pullman National Monument Site — Chicago, IL

Chicago may be most well-known for its blustery weather, but it's also home to a rich labor history as well. The Pullman National Monument Site honors Chicago’s labor history with a series of monuments, museums and other important landmarks — one of which was the scene of a violent strike in the 1890s.

Fun fact: The Pullman District was the first model, planned industrial community in the United States.

- Mother Jones Monument — Union Miners' Cemetery, Mount Olive, IL

This 22-foot granite monument pays tribute to the achievements of Mother Jones, the woman who is credited with co-founding the Industrial Workers of the World labor union and coordinating several major strikes.

Fun fact: The Mother Jones monument is also her official burial site.

- Ludlow Monument — Ludlow, CO

Colorado is a major mining state, producing everything from gold to coal during its mining history. The United Mine Workers of America (UMWA) erected the monument to honor the victims of the Ludlow, CO massacre, an event in which over 1,000 striking coal miners were attacked by the Colorado National Guard and guards from the Colorado Fuel & Iron Company.

Fun fact: Another mining monument, the Victor American Hastings Mine Disaster Monument, is less than two miles away from the Ludlow monument.

- Rosie the Riveter WWII National Historical Park — Richmond, CA

It's no secret that Rosie is one of most recognizable faces of the labor movement. This memorial goes beyond the iconic image to honor all the “Rosies” — working women of WWII and beyond.

Fun fact: The Rosie the Riveter Trust (the nonprofit trust behind the Rosie the Riveter WWII Park) operates a free summer camp for at risk youth called Rosie's Girls. The camp is modeled "after women like Rosie" to help young women gain courage and confidence in their abilities.

Start Your Labor History Travel Adventure

Ready to start your labor history travel adventure? Before you leave town, be sure you're taking advantage of all the Union Plus travel benefits — including:

- Up to 25% off base rates, plus bonus savings on Avis, Budget, and Hertz rental cars.*

- Information on unionized hotels.

- Savings on tours, events, dining and more while you’re traveling.

- And more!

*Terms and Conditions apply.

Across the nation, there are great monuments to the labor union legacy, and some may even be closer than you realize. Add these sites to your travel itinerary to put a union twist on your summer plans and save with Union Plus Travel Benefits.

5 Reasons to Consider Adding a Wellness Plan to Your Pet Insurance Policy

Pet wellness and routine care plans are an optional add on to pet insurance plans offered by Pets Best, and an easy way to keep your pet as healthy as possible. Annual checkups with your veterinarian allow health changes to be addressed and underlying diseases to be caught early. Here are five aspects of routine veterinary care that are crucial for the overall well-being of your pet.

1. Vaccines

Everyone is familiar with vaccines and why our pets need them. Deadly contagious diseases such as Parvo and Distemper are fully preventable in puppies with a simple vaccine. The same is true of the deadly Feline Leukemia Virus and Panleukopenia virus in cats. All puppies and kittens need to have their full series of vaccines and appropriate boosters as they age. Even older pets need to have their boosters updated to prevent deadly infections.

2. Dental Care

Just like humans, pets need their teeth cleaned too! Dogs and cats have plaque and tartar buildup that leads to dental calculus, gingivitis and painful tooth decay. Severe gum disease is a source of chronic infection which can allow bacteria into the bloodstream. These bacteria can latch onto heart valves causing dangerous heart murmurs; bacteria in the blood can also cause abscesses in the liver and elsewhere in the body. It is important to start routine dental cleanings early in life to prevent the teeth from ever decaying and becoming damaged in the first place.

3. Flea and Tick Prevention

Besides being just plain gross, fleas and ticks can really harm your pet. These tiny parasites harbor diseases that can wreak havoc on your pet’s health. Fleas can carry tapeworms which can be transmitted to your pets, and can also cause severe health issues.. It is important that all pets be on appropriate flea and tick control for their geographical area. Many parts of the United States require year round flea and tick control, even in indoor pets.

4. Heartworm Prevention

The number one most common preventable disease in dogs is Heartworms, but did you know that cats can get heartworms too? This deadly worm infection is transmitted from infected animals to your pet by mosquitos, which means that even indoor pets are at risk. Areas with warm, wet weather such as the southeastern United States, the Gulf of Mexico and the Mississippi Delta region have particularly high levels of infected dogs and wildlife. However, heartworms have been reported and diagnosed in all 50 states, so prevention is important no matter where you live.

5. Spay/Neuter

Did you know that spaying or neutering your pet is considered preventative care? Neutering male dogs and cats has several health benefits and can also help decrease aggressive behavior. Female dogs and cats who are not spayed before their first heat cycle have a much higher chance of developing mammary cancer (breast cancer) as they age. Pets who are spayed or neutered, on average, live longer than those pets who are not. These procedures carry very little risk, especially when patients are young and healthy.

Pets Best offers Routine Care Wellness Plans, as an optional add on to all their pet insurance plans.

Dr. Eva Evans is a veterinarian and writer for Pets Best, a U.S. dog and cat insurance agency founded in 2005.

Your pet insurance policy already helps you to keep your cat or dog happy and healthy, but have you considered adding a wellness plan to your pet insurance policy? A wellness plan helps to keep costs down on routine care such as vaccines, boosters, cleanings, and more.

Planning a Road Trip? Five Tips for Rental Car Safety

Renting a car this weekend? Whether you’re heading off for a last-minute getaway or you’ve been planning a trip for months, these simple tips can help you stay safe and enjoy your journey.

1. Prevent Distracted Driving

Safe driving and avoiding distractions are important whenever you’re behind the wheel, and especially if you’ve rented a car to drive in an unfamiliar area. According to the National Highway Traffic Safety Administration (NHTSA), in 2015, over 3,400 people were killed, and 391,000 injured in motor vehicle crashes involving distracted drivers. Distractions may include texting, talking on a phone or anything that causes you to lose focus on the road ahead and driving conditions.

Help reduce the chances of an accident in your rental car by staying focused and alert — make necessary adjustments to your vehicle before you start driving, tell your other passengers to keep noise levels down and don’t respond to calls or text messages while you’re behind the wheel.

2. Plan Your Routes Ahead of Time

You might want your road trip to feel like a spontaneous adventure, but it’s good to have an idea of where you’re going, where you’re staying, what sites you plan to visit, restaurants and rest stops along the way so you can plan your driving route carefully. Online services like Roadtrippers can help you plan ahead, so you can avoid getting lost in an unsafe area, or extra charges for added mileage on your rental car.

3. Let Map Apps Guide You While Driving

Even if you plan your driving routes ahead of your trip, navigation apps like Waze or Google Maps can help keep you on track with voice directions while you’re driving. If you take a wrong turn, most apps will recalculate and help get you back on track, so you don’t have to worry about looking at a map or having your copilot read off directions the whole time. Another bonus, these apps often include navigation adjustments based on real-time construction, road closures or accidents.

Pick up a car mount for your cell phone that attaches to your vehicle’s air vent before your trip so you can stay hands-free while driving.

4. Research Local By-Laws Before You Go

Nothing disrupts a long-anticipated trip like a traffic ticket. Before heading out, research the local laws and regulations, which may differ by state. For example, can you turn right at a red light? Are U-turns legal? And where is it okay to park? Know the rules ahead of time to stay safe and avoid aggravation when you’re driving in a new place.

5. Make Sure You Have Rental Car Insurance

For an extra layer of protection and peace of mind, make sure your car insurance policy covers rental cars. If you have an accident, the costs to the rental agency are covered. These costs could include:

- Loss of use: The agency’s lost daily income because the car couldn’t be used

- Reasonable fees and charges: Like storage or other costs charged by the rental company

- Market value loss of the damaged rental car: In states other than North Carolina, there may be a charge for the loss of value of the car even after it’s been repaired.

Planning ahead for a road trip doesn’t have to be complicated. Make sure your rental car experience is a safe one, so you can save yourself time, money and stress.

MetLife Auto Insurance offered by Union Plus covers rental cars. CALL 1-855-666-5797 and mention discount code DJ7 or GET A QUOTE ONLINE.

There's nothing quite like hitting the open road. Road trips are a great way to explore scenic highways and unfamiliar cities and towns. Stay safe and enjoy your journey with these tips for rental car safety.

Appraisal Myths Debunked

MYTH: THE BORROWER HIRES AN APPRAISER

TRUTH: OK, when we say borrower – we really mean buyer, right? And of course, the buyer wants your appraisal to come in on the lower-end because that opens up the table for further negotiations. But, just to set the record straight – the borrower is responsible for the cost of the appraisal, but they don’t hire or manage the appraisal process – the lender does that. Because, ultimately, the lender wants to make sure they’re making a good investment when lending money to your buyer.

MYTH: MONEY I PUT INTO MY HOME TRANSLATES DOLLAR-FOR-DOLLAR INTO A HIGHER APPRAISAL

TRUTH: Your home improvement projects might increase your home value, but maybe not. It’s up to the market to determine what kind of value they place on a home upgrade.

MYTH: APPRAISERS SET THE VALUE OF THE HOME

TRUTH: Appraisers don’t set the value of the home; they create a credible opinion of how the market will value the home. What someone will pay for the home ultimately determines the value.

We hope this information will help you better understand the appraisal process and the purpose it serves.

And, as always, when you find that perfect home — don't forget the Union Plus Real Estate Rewards program and the Union Plus Mortgage program to help you with your home buying process.

*Certain state restrictions apply to the real estate cash back program. To qualify for cash back rewards (in cash back states), you must use a SIRVA-referred real estate agent. Program designed as a referral service to provide you the opportunity to select a real estate agent to meet your needs. You must evaluate the brokers, agents and their services and make selections and decisions based upon your best judgment, interest, priorities and concerns. Call 800-284-9756 or visit www.up-RealEstateRewards.com for important program details and state restrictions.

SIRVA is an independent provider of services. Union Plus is not affiliated with SIRVA and does not manage SIRVA or its programs. SIRVA is paying Union Plus for advertising services including dissemination of information about SIRVA and its programs to participating unions and their members as well as participation in Union Plus events and programs. No referral, recommendation, service representation or exclusivity requirement is intended by the Union Plus's mention or dissemination of the SIRVA name and delivery of this information to participating union

members.

The appraisal process can be frustrating. It never seems like your home is valued where you think it should be valued. It’s hard (as a seller) not to feel like the whole thing is “rigged” by the buyer.

So, in order to get an objective opinion – we’ve found some good information from The Appraisal Foundation that will set the record straight once and for all – and will hopefully make your upcoming appraisal more enjoyable (if an appraisal can be enjoyable).

Should I Repay My Debt or Invest My Money?

The following is presented for informational purposes only.

Do The Math

Just like everything else in your finances, deciding how to best use your money is all in the calculations. Take a look at your debt and calculate exactly how much it will cost you to pay it off. Be sure to include any interest, fees, and penalties into these calculations. It’s important to get a clear picture of your debt so that you can make the best decision for your finances.

Try using the debt calculator over at Credit Karma. It’s a handy way to see how much your debt is costing you, and how much you can save by increasing your payments.

Next, take a look at your after-tax rate of return on any investments you may be considering. Unless you’re investing in a tax-free bond or a tax-sheltered account, you will most likely need to pay taxes on your earnings, which could decrease your actual return, so keep that in mind.

Since the question is whether to repay debt or make an investment, you want to compare two numbers: the difference between the cost of your debt (primarily interest charges) with this hypothetical additional payment and the cost of your debt without any extra payments; and the potential return on your investments.

We want to know if putting this pool of extra money into debt will save us more money than it could earn as an investment. That’s not the whole story, of course, but finding those two numbers will help provide an objective, numerical baseline for your decision.

Examine Your Financial Situation

If you’re carrying a lot of high interest credit card balances, paying off these debts may be the better way to go for now. Paying off those debts will not only save you money (that you can later invest), it can also help improve your credit score. If you’ve been struggling to balance your finances because of debt payments and building strong credit is a priority for you, then debt repayment is definitely the smart option.

If your debt is manageable and your interest rates are low, however, investing some of your funds might be a wise option. Especially if those investments are part of a long-term savings plan and you manage your risk.

Before making the final decision though, it’s wise to make sure you have ample emergency funds set aside. When it comes to investing, the funds you set aside are usually difficult to access, at least for a period of time. And if you have to withdrawal those funds early, it may come with a penalty that could eat into your returns.

Consider Another Option

There’s one other option you can consider and that is finding a middle ground. Use some of your funds to pay down debt, especially the high-interest loans, and some to invest. This way you can achieve both goals at once. Budget for paying down your debt with as much as you can manage each month so that you can get it paid off faster and avoid interest fees. Then start investing by taking advantage of your employer’s savings plan, like a 401(k), where your employer matches some or all of your deposits. This way you can deposit twice as much into your investment account while still paying off those heavy debts and increasing your credit score.

When it comes to making a decision to repay debt or invest, look at all options, do the calculations, then make the decision that works best for your financial future.

If you need more help understanding how to tackle your personal debt, consider speaking with a certified credit counselor. Counseling is free and includes an objective review of your finances, along with suggested resources and next steps to help you reach your goals.

Union Plus Credit Counseling

Union members can get a no-obligation money and credit assessment from certified, experienced consumer credit counselors though Union Plus Credit Counseling. Powered by the non-profit Money Management International (MMI), your free session will cover a complete financial review, assistance in budgeting, advice for working with creditors, and more.

Which is better, paying off debt or investing your money? There’s no quick and easy answer to this question. The decision involves some comparison between what your debt is costing you and what you expect to make in return for your investments. It also involves taking a close look at your financial situation.

When deciding between debt repayment and investing, here’s what you need to consider:

Do I Need Pet Insurance for My Dog or Cat?

How Does Pet Insurance Work?

In many ways, pet insurance is similar to other types of insurance. Different levels of coverage will be available, and premiums will vary based on the plan selected. Some plans cover only accidents and injuries, while more expensive plans will provide more coverage. Most plans have a deductible, which means you will have to pay a certain amount of the medical expenses. Like any insurance policy, the best scenario is never actually having to use it.

How Much Does Pet Insurance Cost?

The cost of pet insurance will depend on a variety of factors such as the age of your pet. Older pets may also have a pre-existing condition that may not be covered. In general, older pets have higher premiums simply because, like older people, older pets usually require more medical attention. If a pre-existing condition is excluded, however, pet insurance can still help pay for future medical expenses.

Your pet’s breed will also affect the cost of premiums. This is because some breeds are more prone to certain health issues requiring medical attention. Even though premiums may reflect this likelihood, insurance may be even more necessary since your pet is more likely to need medical care.

So Should I Get Pet Insurance?

Just because your pet might not be a “new” member of the family or catches every bug at puppy day care, you can tailor your plan to fit your needs. Pets Best allows you to find the right plan for your pet. By fine tuning your coverage, reimbursement, and deductible levels you can get the best match. There are also flat rate Accident Only plans, because even small levels of protection offered by pet insurance can be invaluable in an emergency.

Consider all of these factors when deciding which pet insurance plan is best for you, your pet and your budget. Investing in pet insurance is investing in your pet’s future health, and provides invaluable peace of mind.

No pet owner likes to think about their pet getting sick or needing surgery. But accidents do happen and pets do get sick. Pet insurance provides you with the comfort of knowing your pet’s medical needs will be met in the event of illness or injury. Union Plus Pet Health Insurance reimburses cat and dog owners for veterinary expenses when their pets get injured.